Shocks, stability, and sustainable markets: does the energy crisis put Europe’s net zero at risk?

The EU energy market has been massively hit by multiple shocks over the past 12 months. Russia's invasion of Ukraine and induced energy crisis have forced Europe to step up efforts to ensure energy independence and security of supply. But are the reaction measures putting decarbonisation and electrification at risk?

The EU promptly adopted gas storage requirements together with electricity and gas demand reduction plans. Yet, the relentless price surge in gas and electricity also led EU countries to intervene in the EU internal energy market with temporary measures.

Governments are now trying to balance market dynamics and protect vulnerable customers without losing track of their long-term decarbonisation targets. Yet, the ongoing energy crisis is now blurring the borders between short-term and long-term, causing risky spillovers for the future of Europe’s carbon neutral energy system.

How best to strike a balance between short-term and long-term priorities in a way that reassures investors, protects costumers, and safeguards the unity of the internal market?

Eurelectric’s Secretary General Kristian Ruby discussed this key question at the Foresight Energy and Climate live podcast Watt Matters on Shocks, stability, and sustainable markets , hosted by Eurelectric on 8 December 2022.

Investments, Investments, Investments

The electricity sector is witnessing a structural underinvestment in power capacity. Eurelectric’s Power Barometer shows that investments in power generation – amounting to 64 billion euros in 2021 – need to increase by 98 billion euros between 2030 and 2050 to meet EU decarbonisation goals. Similarly, electrification rates must jump by nothing less than eleven points compared to today’s levels.

REPowerEU represents a strong signal in the right direction, with calls for an additional 1.6 million heat pumps and of 4.4 million tons of additional hydrogen. Such signals, however, risk being offset by uncareful emergency measures adopted to tackle the price surge.

The uncoordinated implementation of temporary emergency measures across EU countries seriously harms integrated internal electricity market, causing concerns for investment. The current patchwork of revenue caps on low-carbon technologies is a case in point as it is raising uncertainty and undermining investors’ appetite for much-needed renewable and low-carbon infrastructures. Purchasing power agreements, the most common agreements for renewable projects, are now in decline.

Permitting: no uncertainty possible

In a context where certainty is key for boosting investments, emergency measures are also sending dramatically mixed signals on permitting. It is indeed not clear whether accelerated procedures would only apply to new projects or also to the 80% of renewable projects currently stuck in permitting. Member States can in fact choose not to apply streamlined permitting measures to ongoing projects, thereby creating intolerable uncertainty.

Voices of radical changes to the current electricity market design further contribute to this uncertainty.

The electricity market: not the root cause of the crisis

“The internal electricity market is not the heart of today’s crisis. The heart is a demand-supply gap.”

- said Ditte Juul Jørgensen, Director-General DG ENER.

Echoing her words, Kristian Ruby added:

“The current market design must however be key in solving this crisis. It must contribute to stopping it from happening it again and to accelerating the energy transition to a net zero economy in the most sustainable and practical way.”

Making fundamental adjustments to a market built over 20 years in less than 20 months would cloud the outlook and certainty of investors by raising uncertainty and disrupting those price signals that have driven investments in clean and renewable energy for decades.

“Decoupling electricity from gas, as suggested by the “Greek Model” now under discussion would trigger a huge multiyear gap in investments because nobody would know how it works.”

- confirmed Ruby.

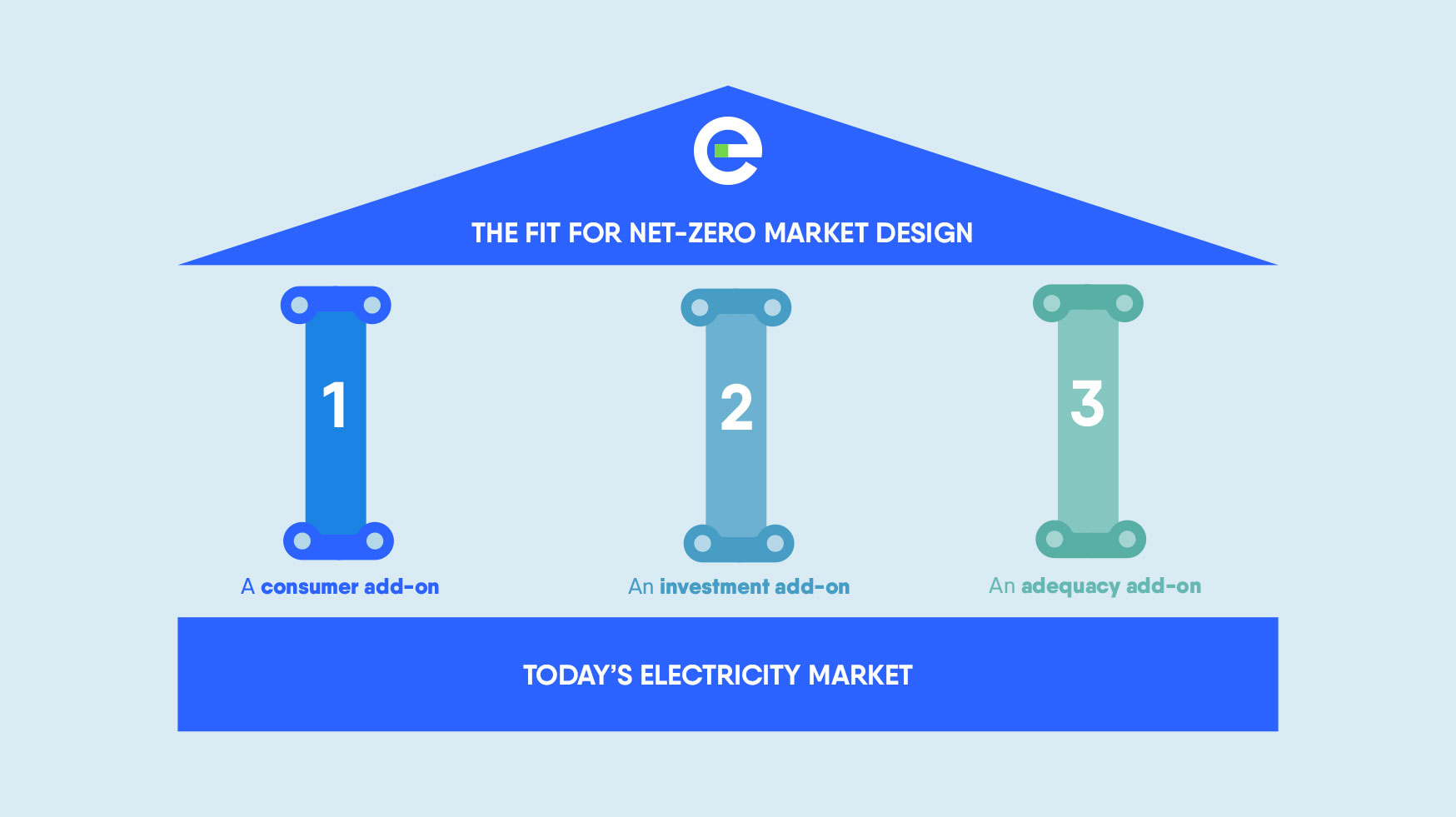

An effective and functioning investment framework based on a more balanced array of short-term and long-term contracting and hedging instruments is now needed to address Europe’s investment gap. The market design reform should therefore aim at an evolution rather than revolution of the current market. As suggested by Eurelectric’s position paper, three key pillars should perfect the current design:

- An enhanced customer contracting framework to bring the benefit of RES and low-carbon generation more directly to consumers through enhanced possibilities for long-term contracting and hedging.

- A market-compatible investment framework for capital intensive renewables and low-carbon technologies, including firm and flexible resources such as demand-side response and storage.

- A security of supply framework that meets the evolving power system needs for increasing decentralisation and flexibility.

These pillars represent Europe’s most effective way to future proof its internal electricity market towards a clear carbon neutral path. So, let’s start building!